Optimizing Medicare for Individuals: Your Path to Wellness

Deciding whether to purchase a Medicare Advantage, Medicare Supplement (Medigap), or Part D prescription drug plan depends on your individual healthcare needs, preferences, and financial situation. Here are some factors to consider for each type of plan:

- Medicare Advantage (Part C) Plan:

- All-in-One Coverage: Medicare Advantage plans typically offer all the benefits of Original Medicare (Parts A and B) and often include additional benefits such as prescription drug coverage (Part D), dental, vision, hearing, and wellness programs.

- Cost Savings: Medicare Advantage plans may have lower monthly premiums compared to Medigap plans. They often have an out-of-pocket maximum limit, providing financial protection against high healthcare costs.

- Managed Care: Many Medicare Advantage plans operate within provider networks and may require referrals to see specialists. If you prefer having your care managed through a network, a Medicare Advantage plan may be suitable.

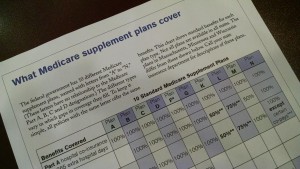

- Medicare Supplement (Medigap) Plan:

- Fill in the Gaps: Medigap plans help cover out-of-pocket costs associated with Original Medicare, such as deductibles, copayments, and coinsurance. If you anticipate frequent healthcare needs and want predictable costs, a Medigap plan may be beneficial.

- Freedom of Choice: Unlike Medicare Advantage plans, Medigap plans typically do not have provider networks, allowing you to see any healthcare provider who accepts Medicare assignment. If you value flexibility in choosing your providers, a Medigap plan might be preferable.

- Stable Coverage: Medigap plans offer standardized benefits, meaning the coverage remains the same regardless of the insurance company you choose. This can provide stability and ease of comparison when selecting a plan.

- Part D Prescription Drug Plan:

- Prescription Drug Coverage: If you take prescription medications regularly, a Part D plan can help cover the costs of your medications. Original Medicare does not cover most prescription drugs, so a Part D plan is essential for obtaining this coverage.

- Financial Protection: Part D plans have formularies that list covered medications and associated costs. Choosing a plan that covers your specific medications can help you avoid high out-of-pocket expenses.

- Access to Pharmacies: Part D plans typically have networks of pharmacies where you can fill your prescriptions. If you have preferred pharmacies or need mail-order services, consider whether the plan’s network meets your needs.

- Medicare Part D coverage is optional, but if you don’t enroll in Part D as soon as you’re eligible, you might pay an on going late-enrollment penalty if you enroll at a later date.

Ultimately, the best choice depends on your healthcare needs, budget, and preferences. It’s essential to compare the costs, coverage, and provider networks of each type of plan before making a decision. Additionally, consider any future healthcare needs and how each plan option may meet those needs over time. Please call our office at 517.263.7770 to set up an appointment to go over your plan options.